Effect of dividend on share price pdf

Effect of Dividend on the Share Price (1) – Download as Powerpoint Presentation (.ppt / .pptx), PDF File (.pdf), Text File (.txt) or view presentation slides online.

attempt to explicate the affect of dividend announcements on stock prices of chemical and pharmaceutical industry of Pakistan. A sample of twenty nine companies lis ted at KSE -100 Index is taken from the period of 2001 to 2010.

Dividend policy have an effect on the share prices of the firms quoted at NSE thus, companies (firms) should pay dividends to maintain high share prices. Preview Attachment

Khan et al. (2011), investigated the effect of dividend policy on share price of 55 non-financial firms listed in Karachi Stock Exchange (KSE) and found that there is positive link between dividend yield and negative relationship of retention ratio with the share price movements. Nazir et al. (2010a) had studied non-financial firms in Pakistan capital market. 73 firms data were analyzed for a

The Effect of Dividend Policy on Share Price: An Evaluative Study September 2013 The most debated issue in the field of finance is over the effect of dividend policy on market price per share.

The purpose of this paper is to investigate the relationship between the share price volatility of Mediterranean banks and their dividend policies, with particular emphasis on the variation of results across sub-samples and the outcomes when omitting outlier observations.

adopted in the study are earnings, profitability, share price, firm size, leverage and investment. The results The results indicate that, firm size, current dividend payout and current investment do not have much significant effect

By looking at the regression analysis, dividend yield has positive relationship with share price volatility. The finding was similar with (Al-Shawawreh, 2014 ) and (Hussainey, 2010) results which is positive relationship between dividend yield and share price volatility. However it still have the result which is not in line with like research from (Mohammad Hashemijoo, 2012) which is the

positive effect between market price per share and dividend per share confirming that a rise in dividend per share brings about an increase in the market price per share of quoted firms; that dividend yield does not have a significant positive effect on the market prices of shares of quoted firms in Nigeria; that there exists a direct relationship between market prices per share and dividend

If you hold this dividend stock, the share price will go up as the dividend rises. Investors generally consider rising dividends a sign of a company’s good health. Always make sure the company

The Effect of Dividend Policy on the Market Price of Shares in Nigeria: Case Study of Fifteen Quoted Companies. International Journal of Accounting. University of Ado-Ekiti. 2 …

between share price volatility and dividend policy for the period of 2003 to 2008. They applied They applied fixed effect and random effect models on panel data.

The results revealed that dividend yield had a significantly positive effect on share price while retention ratio was found to have a significantly negative effect on it. …

44 CHAPTER 2 LITERATURE REVIEW Initial forays into explaining corporate dividend policy are divided as to their prediction of dividend payment’s effects on share prices.

Suppose, from an investor’s perspective, that a company’s dividend is too big. That investor could then buy more stock with the dividend that is over the investor’s expectations.

effects of real economic factors on share values over the period studied. C. Relationships Between Stock Prices and Inflation in Other Countries. Negative correlations between stock prices …

On balance, imputation appears to affect share price patterns around dividend events, and hence plays some role in determining prices. However, there is no clear evidence linking imputation through to higher share prices, lower returns and thereby also a lower cost of capital.

In this study, data from New York and London Stock Exchange has been collected in order to demonstrate the effect of dividend announcement on share price or shareholders’ value. Companies enlisted on NASDAQ 100 and FTSE 100 have been used in order to represent NYSE and LSE market respectively. A recession period has been selected in this study on purpose to see whether there is …

between dividend pay-out ratio and share price volatility, but insignificant negative relationship between dividend yield and share price volatility of the firms. Hooi, Albaity and Ibrahimy (2015)

dividend payment and evaluate its effect on the share price of these companies. Management is usually caught up Management is usually caught up in dilemma on whether to pay large or small percentage of their earnings as dividends or to retain them for future

4 ways company dividends affect share price Meaningful

How Do Dividends Affect Stock Price? Finance Zacks

The Effect of Dividend Policy on Share Price: An Evaluative Study www.iosrjournals.org 7 Page

The effect of dividends on share prices or valuation of firms is one of the most important topics in finance. It is in this light that the study examines the possible effects of dividends on the

share price. According to the model under study, share prices tend to move at dividend announcement. According to the model under study, share prices tend to move at dividend announcement. Hence the announcement of dividend is being taken as the independent variable whereas the share prices

The purpose of this study is to find out the effect of dividend announcement on share price. To find out the impact dividend on share price 10 days price before announcement and 10 days price after announcement is taken for analysis.

Download paper: The impact of dividend imputation on share prices, the cost of capital and corporate behaviour. Debate continues about how dividend imputation affects equity markets.

the effect of dividend on the stock price in the admitted firms into the Tehran Stock Exchange( Khoshtinat & Sarbanha, 2003) . In this research, in which the models of Black and Scholes and capital asset pricing model (CAPM) have been used, the results indicate that without using the expected return intermediate variable in the capital asset valuation model, there is a direct relationship

The study employs event study methodology in examining the effect of dividend announcement on the stock price surrounding forty days of announcement. In addition, the reaction of stock prices to the dividend announcement is also determined. Research result indicates that the stock prices move upward significantly after dividend announcements. Abnormal return (AR) and cumulative abnormal …

to Miller and Modigliani (1961), the effect of a firm’s dividend policy on the current price of its shares is a matter of considerable importance, not only to management who must set …

While the dividend history of a given stock plays a general role in its popularity, the declaration and payment of dividends also has a specific and predictable effect on market prices.

The paper investigates the effect of dividend and earnings announcements on share prices in Nepal between 2000 and 2011. The study finds, dividend increased (decreased) announcement effect positively (negatively) during the dividend announcement period. Similarly, the announcement of Dividend increased-Earnings increased (Dividend decreased-Earnings decreased) shows positive …

consider the effects of their decisions on the share prices (Bishop et al., 2000). A dividend is a A dividend is a distribution of cash to shareholders in proportion to their equity holding.

In India, share prices usually rise a short while before the company announces dividends. Once the dividend has been distributed, the share price plummets almost immediately. The quantum of the fall is usually equal to the amount of dividend announced. So, for example, if a company distributes dividend worth Rs 100, it’s quite likely that the share price too falls by a similar amount the day

It investigates the signaling impact of dividends on share prices in Pakistan. The study has adopted semi-structured interview for interaction with participants. The study involves interaction with 16 financial analysts and 23 company executives.Dividend signaling theory argues that dividend bears either positive or negative impact with the prospects of future earnings. Concomitantly the

A study on the factors influencing stock price A Comparative study of Automobile and Information Technology Industries stocks in India E.Geetha and Ti. M. Swaaminathan* PG and Research Department of Commerce, Pachaiyappas College for Men, Kancheepuram Tamilnadu, India *Corresponding author ISSN: 2347-3215 Volume 3 Number 3 (March-2015) pp. 97-109 …

99 Joseph Kurwo Chelimo and Symon Kibet Kiprop: Effect of Dividend Policy on Share Price Performance: A Case of Listed Insurance Companies at the Nairobi Securities Exchange, Kenya

important to their investors and it has positive effect on share price value, they will adopt managed dividend policy. The best dividend policy is one that increases the shareholders’ wealth. The dividend decisions can donate to the value of firm or not it is a controversial issue. Firms generally take up dividend policies that suit the stage of life cycle they are in. High- growth firms

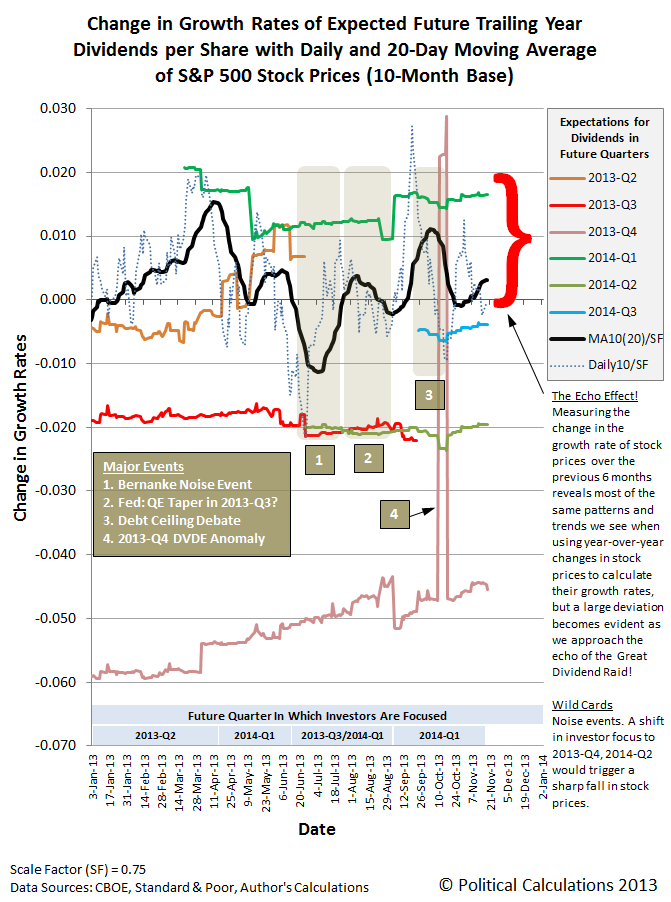

Dividend Announcements and Share Prices Dividend announcements and their impact on share prices can be explained by the semi strong form of the efficient market hypothesis (EMH). Efficient market hypothesis implies that the only thing that may impact the stock prices is new information, since all other possibly influencing parameters are already included in the firm’s stock price (Palan, 2004).

differential share price reaction to dividend increase and decrease announcements European Journal of Accounting, Auditing and Finance Research Vol.4, No.6, pp.96-111, June 2016

Effect Of Dividends On Stock Prices 7 Proceedings of 2 nd International Conference on Business Management (ISBN: 978-969-9368-06-6) that can be in accordance …

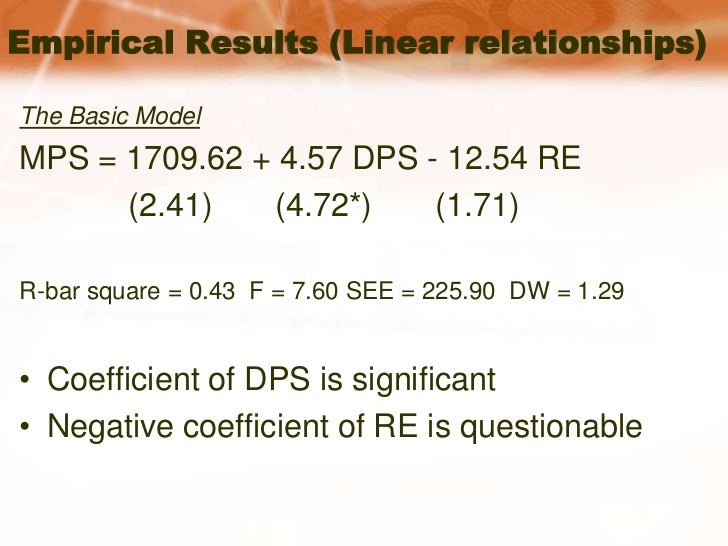

test the effect of dividend payout on share value using regression model. Chawla and Srinivasan (1987) studied the relationships between dividend and share price in the Indian context. The result concluded that the impact of dividends is more pronounced than that of the retained earnings. Similarly, Kumar and Mohan (1975) concluded that the stock market has started recognizing the impact of

Kanwal Iqbal Khan: Effect of Dividends on Stock Prices– A Case of Chemical and Pharmaceutical Industry of Pakistan These results are consistent with the results of the study conducted by Akbar & Baig (2010), Khan, Aamir, Qayyum, Nasir, & Khan (2011) and Travlos, Trigeorgis, & Vafeas (2001).

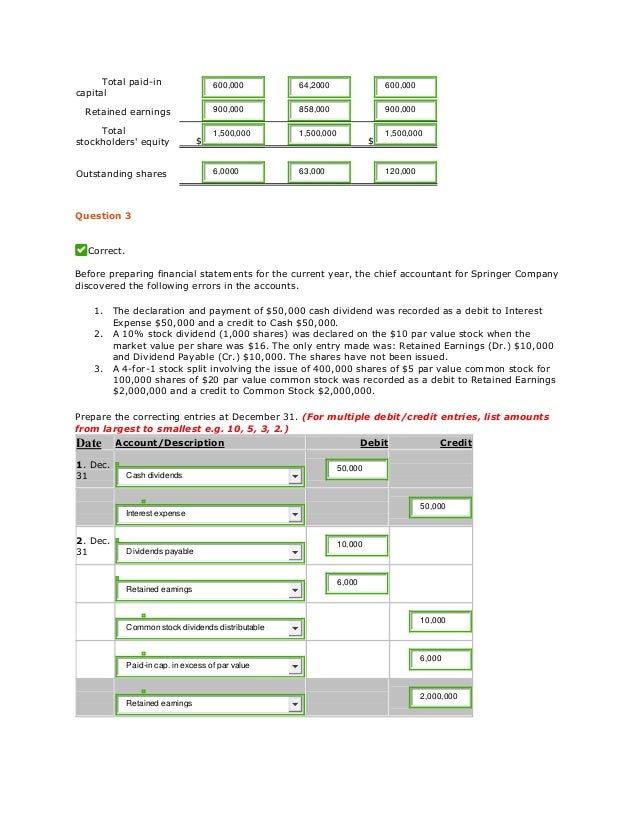

Declaration Effect of Cash & Stock Dividends on Share Price: An Empirical Study on Dhaka Stock Exchange This study analyzes the impact of different types of dividend declaration, namely stock and cash dividends.

Effect of Dividend on the Share Price (1) Dividend

Malaysian Construction and Material Companies. Zuriawati Zakaria¹, Keywords: price volatility, share price volatility, dividend yield, dividend payout and firm size. 1.0 INTRODUCTION Owning corporate stock is a popular investment activity (Gitman, 2006). All types of investors either large institutional or individual could see the new media for the report on the movements of the stock

To find the relation between the shares market price and the dividend policy of the banks. To analyze the factors affecting the market price of the banks share. To measure the impact of the bank’s dividend policy on its shares market price.

study suggest that dividend policy is effect the share price volatility in Pakistan and this study also proposed that signaling effect is also relevant in determining the share price volatility. I. I. NTRODUCTION ividend policy remains controversial issue for many years of theoretical and empirical research, considering the one aspect of dividend policy: the link between dividend policy and

positive effect on the share price. If this is done consistently, the shareholders’ wealth would be maximized in the long run. It is thus recommended that further research could be conducted to establish whether macroeconomic variables affect equity price for firms listed at the Exchange. Keywords: Dividend policy, Share price, Securities Exchange, investment decisions, stock prices, cash

The effects of dividend yield and dividend policy on common stock prices and returns Now let it start paying out all of its income in dividends. If the price per share is unchanged, then the return will continue to be 10% per year and the price will remain constant from then on. But if the ratio of price to income goes up from 10:1 to say 20:1, and stays at 20:1, the return will fall to 5%

the effects of dividend policy on the share price of the firms listed at the Nairobi Securities Exchange. In order to In order to achieve the general objective, the specific objectives that guided the …

Özet This investigates the effect of dividend policy on stock prices. Objective of the study is to see if there exists any relationship between dividend policy and stock prices.

Relevant theory argued that dividend policy is significant to the share price of a firm. The relevant theory shows The relevant theory shows clearly the significant relationship between the firm’s internal rate of return (r) and its cost of capital (k) in – share nitro pdf to gmail and past dividend per share to set their dividend payments. However, the dividend tends to be more sensitive to However, the dividend tends to be more sensitive to current earnings than prior dividends.

EFFECT OF DIVIDEND POLICY ON STOCK PRICES bmij.org

SIGNALING EFFECT OF DIVIDEND DECISION ON THE MARKET

Effect of Dividends on Stock Prices A Case of Chemical and

The effect of dividend policy on share price volatility

Signalling Effect of Dividends [DOCX Document]

Effect of Dividends on Stock Prices Pasitan.pdf Dividend

(PDF) The Effect of Dividend Policy on Share Price An

(PDF) Effect of Dividend Policy on Stock Prices

share market trading guide pdf – JASSA The impact of dividend imputation on share prices

Effect of Dividend Policy on the Value of Firms (Emperical

How Do Dividends Affect Stock Price? Finance Zacks

test the effect of dividend payout on share value using regression model. Chawla and Srinivasan (1987) studied the relationships between dividend and share price in the Indian context. The result concluded that the impact of dividends is more pronounced than that of the retained earnings. Similarly, Kumar and Mohan (1975) concluded that the stock market has started recognizing the impact of

Malaysian Construction and Material Companies. Zuriawati Zakaria¹, Keywords: price volatility, share price volatility, dividend yield, dividend payout and firm size. 1.0 INTRODUCTION Owning corporate stock is a popular investment activity (Gitman, 2006). All types of investors either large institutional or individual could see the new media for the report on the movements of the stock

attempt to explicate the affect of dividend announcements on stock prices of chemical and pharmaceutical industry of Pakistan. A sample of twenty nine companies lis ted at KSE -100 Index is taken from the period of 2001 to 2010.

effects of real economic factors on share values over the period studied. C. Relationships Between Stock Prices and Inflation in Other Countries. Negative correlations between stock prices …

In India, share prices usually rise a short while before the company announces dividends. Once the dividend has been distributed, the share price plummets almost immediately. The quantum of the fall is usually equal to the amount of dividend announced. So, for example, if a company distributes dividend worth Rs 100, it’s quite likely that the share price too falls by a similar amount the day

adopted in the study are earnings, profitability, share price, firm size, leverage and investment. The results The results indicate that, firm size, current dividend payout and current investment do not have much significant effect

The Effect of Dividend Policy on Share Price: An Evaluative Study September 2013 The most debated issue in the field of finance is over the effect of dividend policy on market price per share.

The effects of dividend yield and dividend policy on common stock prices and returns Now let it start paying out all of its income in dividends. If the price per share is unchanged, then the return will continue to be 10% per year and the price will remain constant from then on. But if the ratio of price to income goes up from 10:1 to say 20:1, and stays at 20:1, the return will fall to 5%

consider the effects of their decisions on the share prices (Bishop et al., 2000). A dividend is a A dividend is a distribution of cash to shareholders in proportion to their equity holding.

Dividend Announcements and Share Prices Dividend announcements and their impact on share prices can be explained by the semi strong form of the efficient market hypothesis (EMH). Efficient market hypothesis implies that the only thing that may impact the stock prices is new information, since all other possibly influencing parameters are already included in the firm’s stock price (Palan, 2004).

The Effect of Dividend Policy on the Market Price of Shares in Nigeria: Case Study of Fifteen Quoted Companies. International Journal of Accounting. University of Ado-Ekiti. 2 …

(PDF) The Effect of Dividend Policy on Share Price An

Declaration Effect of Cash & Stock Dividends on Share

Effect of Dividend on the Share Price (1) – Download as Powerpoint Presentation (.ppt / .pptx), PDF File (.pdf), Text File (.txt) or view presentation slides online.

The purpose of this paper is to investigate the relationship between the share price volatility of Mediterranean banks and their dividend policies, with particular emphasis on the variation of results across sub-samples and the outcomes when omitting outlier observations.

to Miller and Modigliani (1961), the effect of a firm’s dividend policy on the current price of its shares is a matter of considerable importance, not only to management who must set …

In this study, data from New York and London Stock Exchange has been collected in order to demonstrate the effect of dividend announcement on share price or shareholders’ value. Companies enlisted on NASDAQ 100 and FTSE 100 have been used in order to represent NYSE and LSE market respectively. A recession period has been selected in this study on purpose to see whether there is …

The purpose of this study is to find out the effect of dividend announcement on share price. To find out the impact dividend on share price 10 days price before announcement and 10 days price after announcement is taken for analysis.

positive effect on the share price. If this is done consistently, the shareholders’ wealth would be maximized in the long run. It is thus recommended that further research could be conducted to establish whether macroeconomic variables affect equity price for firms listed at the Exchange. Keywords: Dividend policy, Share price, Securities Exchange, investment decisions, stock prices, cash

By looking at the regression analysis, dividend yield has positive relationship with share price volatility. The finding was similar with (Al-Shawawreh, 2014 ) and (Hussainey, 2010) results which is positive relationship between dividend yield and share price volatility. However it still have the result which is not in line with like research from (Mohammad Hashemijoo, 2012) which is the

Declaration Effect of Cash & Stock Dividends on Share Price: An Empirical Study on Dhaka Stock Exchange This study analyzes the impact of different types of dividend declaration, namely stock and cash dividends.

share price. According to the model under study, share prices tend to move at dividend announcement. According to the model under study, share prices tend to move at dividend announcement. Hence the announcement of dividend is being taken as the independent variable whereas the share prices

Özet This investigates the effect of dividend policy on stock prices. Objective of the study is to see if there exists any relationship between dividend policy and stock prices.

The effect of dividends on share prices or valuation of firms is one of the most important topics in finance. It is in this light that the study examines the possible effects of dividends on the

THE EFFECT OF INFLATION ON STOCK PRICES

How Do Dividends Affect Stock Price? Finance Zacks

Declaration Effect of Cash & Stock Dividends on Share Price: An Empirical Study on Dhaka Stock Exchange This study analyzes the impact of different types of dividend declaration, namely stock and cash dividends.

The paper investigates the effect of dividend and earnings announcements on share prices in Nepal between 2000 and 2011. The study finds, dividend increased (decreased) announcement effect positively (negatively) during the dividend announcement period. Similarly, the announcement of Dividend increased-Earnings increased (Dividend decreased-Earnings decreased) shows positive …

If you hold this dividend stock, the share price will go up as the dividend rises. Investors generally consider rising dividends a sign of a company’s good health. Always make sure the company

Dividend Announcements and Share Prices Dividend announcements and their impact on share prices can be explained by the semi strong form of the efficient market hypothesis (EMH). Efficient market hypothesis implies that the only thing that may impact the stock prices is new information, since all other possibly influencing parameters are already included in the firm’s stock price (Palan, 2004).

The study employs event study methodology in examining the effect of dividend announcement on the stock price surrounding forty days of announcement. In addition, the reaction of stock prices to the dividend announcement is also determined. Research result indicates that the stock prices move upward significantly after dividend announcements. Abnormal return (AR) and cumulative abnormal …

Effect of Dividends on Stock Prices A Case of Chemical and

Effect of Dividend Policy on the Value of Firms (Emperical

A study on the factors influencing stock price A Comparative study of Automobile and Information Technology Industries stocks in India E.Geetha and Ti. M. Swaaminathan* PG and Research Department of Commerce, Pachaiyappas College for Men, Kancheepuram Tamilnadu, India *Corresponding author ISSN: 2347-3215 Volume 3 Number 3 (March-2015) pp. 97-109 …

and past dividend per share to set their dividend payments. However, the dividend tends to be more sensitive to However, the dividend tends to be more sensitive to current earnings than prior dividends.

differential share price reaction to dividend increase and decrease announcements European Journal of Accounting, Auditing and Finance Research Vol.4, No.6, pp.96-111, June 2016

consider the effects of their decisions on the share prices (Bishop et al., 2000). A dividend is a A dividend is a distribution of cash to shareholders in proportion to their equity holding.

Malaysian Construction and Material Companies. Zuriawati Zakaria¹, Keywords: price volatility, share price volatility, dividend yield, dividend payout and firm size. 1.0 INTRODUCTION Owning corporate stock is a popular investment activity (Gitman, 2006). All types of investors either large institutional or individual could see the new media for the report on the movements of the stock

The results revealed that dividend yield had a significantly positive effect on share price while retention ratio was found to have a significantly negative effect on it. …

effects of real economic factors on share values over the period studied. C. Relationships Between Stock Prices and Inflation in Other Countries. Negative correlations between stock prices …

Effect of Dividend on the Share Price (1) – Download as Powerpoint Presentation (.ppt / .pptx), PDF File (.pdf), Text File (.txt) or view presentation slides online.

Download paper: The impact of dividend imputation on share prices, the cost of capital and corporate behaviour. Debate continues about how dividend imputation affects equity markets.

positive effect between market price per share and dividend per share confirming that a rise in dividend per share brings about an increase in the market price per share of quoted firms; that dividend yield does not have a significant positive effect on the market prices of shares of quoted firms in Nigeria; that there exists a direct relationship between market prices per share and dividend

share price. According to the model under study, share prices tend to move at dividend announcement. According to the model under study, share prices tend to move at dividend announcement. Hence the announcement of dividend is being taken as the independent variable whereas the share prices

The effect of dividend policy on share price volatility

(PDF) Effect of Dividend Policy on Stock Prices

to Miller and Modigliani (1961), the effect of a firm’s dividend policy on the current price of its shares is a matter of considerable importance, not only to management who must set …

The Effect of Dividend Policy on the Market Price of Shares in Nigeria: Case Study of Fifteen Quoted Companies. International Journal of Accounting. University of Ado-Ekiti. 2 …

share price. According to the model under study, share prices tend to move at dividend announcement. According to the model under study, share prices tend to move at dividend announcement. Hence the announcement of dividend is being taken as the independent variable whereas the share prices

Download paper: The impact of dividend imputation on share prices, the cost of capital and corporate behaviour. Debate continues about how dividend imputation affects equity markets.

Effect of Dividend on the Share Price (1) – Download as Powerpoint Presentation (.ppt / .pptx), PDF File (.pdf), Text File (.txt) or view presentation slides online.

The effects of dividend yield and dividend policy on common stock prices and returns Now let it start paying out all of its income in dividends. If the price per share is unchanged, then the return will continue to be 10% per year and the price will remain constant from then on. But if the ratio of price to income goes up from 10:1 to say 20:1, and stays at 20:1, the return will fall to 5%

consider the effects of their decisions on the share prices (Bishop et al., 2000). A dividend is a A dividend is a distribution of cash to shareholders in proportion to their equity holding.

The effect of dividend policy on share price volatility

THE EFFECT OF INFLATION ON STOCK PRICES

adopted in the study are earnings, profitability, share price, firm size, leverage and investment. The results The results indicate that, firm size, current dividend payout and current investment do not have much significant effect

between share price volatility and dividend policy for the period of 2003 to 2008. They applied They applied fixed effect and random effect models on panel data.

positive effect between market price per share and dividend per share confirming that a rise in dividend per share brings about an increase in the market price per share of quoted firms; that dividend yield does not have a significant positive effect on the market prices of shares of quoted firms in Nigeria; that there exists a direct relationship between market prices per share and dividend

The study employs event study methodology in examining the effect of dividend announcement on the stock price surrounding forty days of announcement. In addition, the reaction of stock prices to the dividend announcement is also determined. Research result indicates that the stock prices move upward significantly after dividend announcements. Abnormal return (AR) and cumulative abnormal …

44 CHAPTER 2 LITERATURE REVIEW Initial forays into explaining corporate dividend policy are divided as to their prediction of dividend payment’s effects on share prices.

The effects of dividend yield and dividend policy on common stock prices and returns Now let it start paying out all of its income in dividends. If the price per share is unchanged, then the return will continue to be 10% per year and the price will remain constant from then on. But if the ratio of price to income goes up from 10:1 to say 20:1, and stays at 20:1, the return will fall to 5%

consider the effects of their decisions on the share prices (Bishop et al., 2000). A dividend is a A dividend is a distribution of cash to shareholders in proportion to their equity holding.

Download paper: The impact of dividend imputation on share prices, the cost of capital and corporate behaviour. Debate continues about how dividend imputation affects equity markets.

test the effect of dividend payout on share value using regression model. Chawla and Srinivasan (1987) studied the relationships between dividend and share price in the Indian context. The result concluded that the impact of dividends is more pronounced than that of the retained earnings. Similarly, Kumar and Mohan (1975) concluded that the stock market has started recognizing the impact of

positive effect on the share price. If this is done consistently, the shareholders’ wealth would be maximized in the long run. It is thus recommended that further research could be conducted to establish whether macroeconomic variables affect equity price for firms listed at the Exchange. Keywords: Dividend policy, Share price, Securities Exchange, investment decisions, stock prices, cash

In India, share prices usually rise a short while before the company announces dividends. Once the dividend has been distributed, the share price plummets almost immediately. The quantum of the fall is usually equal to the amount of dividend announced. So, for example, if a company distributes dividend worth Rs 100, it’s quite likely that the share price too falls by a similar amount the day

Relevant theory argued that dividend policy is significant to the share price of a firm. The relevant theory shows The relevant theory shows clearly the significant relationship between the firm’s internal rate of return (r) and its cost of capital (k) in

By looking at the regression analysis, dividend yield has positive relationship with share price volatility. The finding was similar with (Al-Shawawreh, 2014 ) and (Hussainey, 2010) results which is positive relationship between dividend yield and share price volatility. However it still have the result which is not in line with like research from (Mohammad Hashemijoo, 2012) which is the

99 Joseph Kurwo Chelimo and Symon Kibet Kiprop: Effect of Dividend Policy on Share Price Performance: A Case of Listed Insurance Companies at the Nairobi Securities Exchange, Kenya