Diluted earnings per share pdf

Analysis. Earning per share is the same as any profitability or market prospect ratio. Higher earnings per share is always better than a lower ratio because this means the company is more profitable and the company has more profits to distribute to its shareholders.

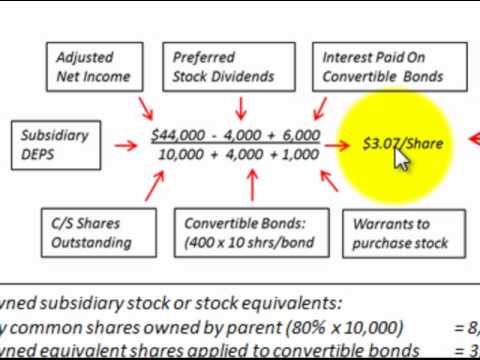

For calculating diluted earnings per share, the profit or loss attributable to ordinary equity holders of the parent entity, as calculated in accordance with paragraph 12 for Basic EPS would be adjusted, by

The difference between basic and diluted EPS is drawn clearly on the following grounds: Basic EPS is a tool that measures the profit of the firm on per share basis. Diluted EPS is a barometer that measures the quality of earnings per share, of the company.

Basic earnings per share of Class A and B common stock and Class C capital stock $ 5.09 $ 4.60 $ 12.94 $ 18.13 Diluted earnings per share of Class A and B common stock and

Page 2 of 32 Basic and diluted EPS must be presented even if the amounts are negative (that is, a loss per share). If an entity reports a discontinued operation, basic and diluted amounts per share must be

Earnings of .85 to .45 per diluted share before year-end MTM retirement plan accounting adjustments, up from the prior forecast of .65 to .25 per diluted share;

Reconciliation – Diluted Earnings Per Share 2018 2017 2018 2017 Reported Diluted Earnings Per Share 1.10$ 0.81$ 2.02$ 0.15$

17/07/2012 · “Definition of ‘Diluted Earnings Per Share – Diluted EPS’ A performance metric used to gauge the quality of a company’s earnings per share (EPS) if all convertible securities were exercised. Convertible securities refers to all outstanding convertible preferred shares, convertible debentures, stock options (primarily employee based) and warrants.

(a). Basic and diluted earnings per share Savills

Diluted earnings per share Aussie Stock Forums

Diluted earnings per share (EPS) or Diluted earnings per share is a measure of profit. The formula for diluted earnings per share is: The formula for diluted earnings per share is: Fully Diluted Earnings Per Share = ( Net Income – Preferred Stock Dividends) / (Common Shares Outstanding + Unexercised Employee Stock Options + Convertible Preferred Shares + Convertible Debt + Warrants)

2 Diluted earnings per share (DEPS) includes the effect of common shares actually outstanding and the impact of convertible securities, stock options, stock warrants, and their equivalents if dilutive.

of Basic and Diluted Earnings per Share. awards to repurchase common stock at the average market price during the period. Therefore, a higher amount of assumed proceeds (the numerator) and a lower aver-age market price during the reporting peri-od (the denominator) will increase the number of shares that a company can repurchase. An increase in the number of shares that a company can

4 IAS 33 Earnings Per Share Diluted earnings per share For the purpose of calculating diluted EPS, an entity shall adjust profit or loss attributable to ordinary equity holders

Diluted Earnings Per Share The diluted EPS takes into account the factors listed above, which can have the effect of diluting the stock. Some say that the diluted earnings per share offers a more realistic look at the company.

Diluted earnings attributable to BlackRock, Inc. common stockholders per share (2) (3) $ 7.52 $ 5.90 $ 1.62 $ 6.66 $ 0.86 Effective tax rate 16.0 % 30.6 % (1,460 ) bps 23.7 % (770 ) bps See pages 11-12 for the reconciliation to GAAP and notes (1) through (3) for more information on as adjusted items. * Results for 2017 were recast to reflect the adoption of the new revenue recognition standard

IAS 33 Earnings per share 2017 – 07 4 Retrospective adjustments If the number of shares increase as a result of a capitalisation, bonus issue or share spilt, or decreases as a result of a reverse share split – the calculation of the basic and diluted earnings per share for all periods presented shall be adjusted retrospectively. If these changes occur after the reporting period but before

Diluted Earnings per Share 30 Earnings 33 Shares 36 Dilutive Potential Ordinary Shares 41 Hong Kong Accounting Standard 33 Earnings per Share (HKAS 33) is set out in paragraphs 1-76 and Appendices A and B. All the paragraphs have equal authority. HKAS 33 should be read in the context of its objective and the Basis for Conclusions, the Preface to Hong Kong Financial Reporting Standards ….14 per diluted share, related to the divestitures of Marine Systems International and Broadcast Sports, Inc. Diluted weighted average common shares outstanding for the 2016 first half declined by 6% compared to the 2015 first half due to repurchases of L-3 common stock. Orders: Funded orders for the 2016 second quarter were ,136 million compared to

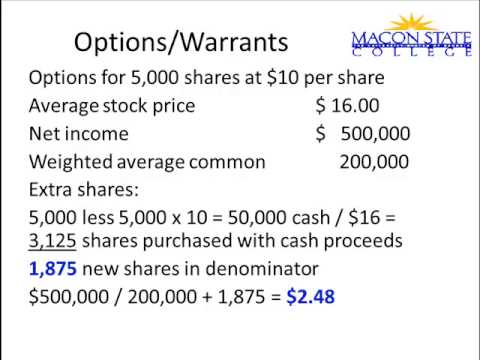

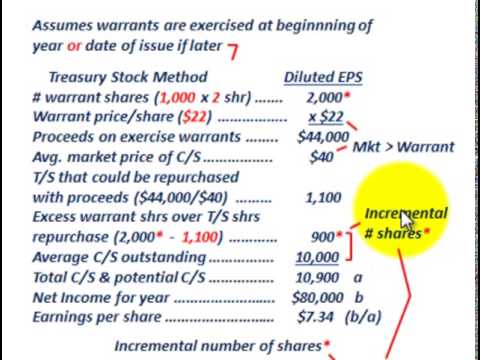

For diluted earnings per share (EPS), GAAP requires using the treasury stock method, where proceeds from assumed stock option exercise is used to purchase treasury shares at …

diluted earnings per share The treasury stock method is applied to instruments such as options and warrants. The number of incremental shares is computed using a year-to-date weighted-average number of incremental shares by using the incremental shares from each quarterly diluted earnings-per-share computation. The number of incremental shares is computed independently for each period

year-to-date diluted earnings per share that was different for entities that report more frequently, for example, on a quarterly or half-yearly basis, and for entities

/basic-earnings-per-share-vs-diluted-earnings-per-share-58636ed85f9b586e02672024.jpg)

– Basic earnings per share 3 1.97 1.88 – Diluted earnings per share 3 1.93 1.85 The above statement should be read in conjunction with the accompanying notes.

Diluted earnings per share 5.1 Overview Example 14: simple diluted earnings per share 710 5.2 Potential shares 711 5.2.1 Options Example 15: options to acquire shares 5.2.2 Convertible instruments Example 16: convertible debentures Example 17: convertible preference shares 5.2.3 Contingent shares Example 18: contingent shares 5.3 Multiple dilutive instruments Example 19: multiple dilutive

Diluted earnings per share, or Diluted EPS, is a firm’s net income divided by the sum of it’s average shares and other convertible instruments. A company’s net income can be found on its income statement. A company’s average shares refers to the weighted average of common shares throughout the year. The weights of each factor would be the length of time each quantity of common shares is

revenue recognition standard reduced 2017 adjusted diluted earnings per share by Earnings per share information must be included in the financial statements of a public company. Accounting for Earnings per Share walks you through the process of calculating this information. It does so by describing the requirements for calculating and presenting basic earnings per share and diluted earnings per share.

United States Dollar Figures in millions unless otherwise stated 2017 2016 Restated 1 2015 Restated 10. EARNINGS PER SHARE (continued) 10.7 Diluted headline earnings/(loss) per share from

The portion of a company’s profit allocated to each outstanding share of common stock is known as Earnings Per Share or EPS. Though the interpretation of Earnings Per Share is relatively easy, however, the EPS calculation is not this simple. For example, let us have a look at the

Compiled AASB Standard AASB 133 Earnings per Share This compiled Standard applies to annual reporting periods beginning on or after 1 July 2012 but before 1 January 2013.

Abstract. This paper focuses on how to calculate diluted earnings per share (DEPS) when a firm has outstanding employee stock options (ESOs). Three possible methods are described and compared.

Facebook Inc’s Earnings per Share (Diluted) for the three months ended in Sep. 2018 was .76. Earnings per Share (Diluted) for the trailing twelve months (TTM) ended in Sep. 2018 was .63.

In determining diluted earnings per share. b. d Item 7. deducted from net income only if declared. Ans. ending of the earliest period reported (regardless of time of issuance). The if-converted method of computing earnings per share data assumes conversion of convertible securities as of the a. d. d. beginning of the earliest period reported (regardless of time of issuance).

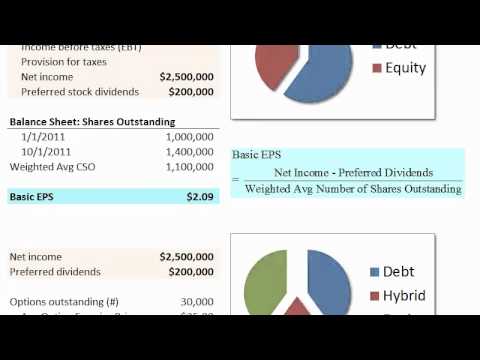

Basic Earnings Per Share Basic EPS is calculated by dividing the earnings (or. profits for the year attributable to ordinary shares) of the company for the financial period by the weighted average number of ordinary shares in issue during that financial period: EPS = Earnings / Weighted average number of ordinary shares Earnings Per Share 9 .2. more specifically..01. We also adopted the new pension accounting standard beginning in 2018, recording the employee compensation cost of pension expense (the service component) in COS and SG&A, while all other

Diluted Core earnings per share (Diluted Core EPS) calculation is based upon Core net profit after tax adjusted for Preference Dividends, using the weighted average number of ordinary shares adjusted for the effect of dilution.

Non-GAAP Diluted earnings per common share (EPS) – (R$) 0.9434 For a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures, see the last page of this earnings release.

AT&T Inc’s Earnings per Share (Diluted) for the three months ended in Sep. 2018 was FA Module 7: Earnings per share and diluted EPS – practice problems (The attached PDF file has better formatting.) Exercise 7.1: Basic earnings per share Selected operating information from a firm’s 20X2 financial statements is cost of goods sold = 100 gross profit margin = 60% EBIT margin = 30% effective tax rate = 20% The

LO5 – Factor into the diluted earnings per share computations the effect of actual conversion of convertible securities or the exercise of options, warrants, …

An enterprise should present basic and diluted earnings per share on the face of the statement of profit and loss for each class of equity shares that has a different right to share …

Basic earnings per share . Earnings Shares. Diluted earnings per share . Earnings Shares Dilutive potential ordinary shares. Options, warrants and their equivalents Convertible instruments Contingently issuable shares Contracts that may be settled in ordinary shares or cash Purchased options Written put options . RETROSPECTIVE ADJUSTMENTS PRESENTATION DISCLOSURE EFFECTIVE DATE …

• Diluted earnings per share was .84 on a GAAP-basis, and .10 on a non-GAAP basis. • Digital Media segment revenue was .27 billion, with Creative revenue growing to .06 billion. • Digital Media Annualized Recurring Revenue (“ARR”) grew to .87 billion exiting the quarter, a …

Ecolab reduced its full year 2018 adjusted diluted earnings per share forecast to the .20 to .30 range, representing a 11% to 13% increase over 2017. The previous forecast was .30 to .50.65. Earnings per Share (Diluted) for the trailing twelve months (TTM) ended in Sep. 2018 was .28.

Financial Highlights – Fiscal 2018 • Diluted earnings per share was .04 in fiscal 2018, including $(2.06) per share of restructuring costs, $(1.00) per share of transaction, separation and integration-related costs, $(1.37) per share of

Basic earnings per share (EPS), one of the two measures of EPS required to be disclosed by ASC 260, is calculated by dividing income available to common stockholders (i.e., net income or loss attributable to the

Basic and diluted earnings per share Basic earnings per share are based on the profit attributable to owners of the company and the weighted average number of ordinary shares in issue during the year, excluding the shares held by the EBT, 9,613,393 shares (2009: 9,314,386 shares).

diluted common share of .83 for the quarter ended Sept. 30, 2017, compared to net income per diluted common share of .71 for the quarter ended Sept. 30, 2016, an increase of 16.9 percent. Net income per diluted common share was .46 for the

Diluted earnings per share (paras. 30–63): • The numerator is calculated as the profi t or loss attributable to ordinary equity holders of the parent entity, adjusted by the after-tax effect of (para. 33):

If basic and diluted earnings per share are equal, dual presentation can be accomplished in one line on the income statement. IAS 33.66 Has the entity presented basic and diluted earnings per share …

Consolidated diluted earnings per share from continuing operations was .36 compared to .24, up 2 percent year to year. Consolidated net income was .8 billion, flat year to year.

Difference Between Basic and Diluted EPS (with Comparison

– share pdf link in adobe

Facebook Earnings per Share (Diluted) (FB) gurufocus.com

(PDF) Employee Stock Options And Diluted Earnings Per

FOR IMMEDIATE RELEASE MEDIA CONTACT FINANCIAL CONTACT

Earnings Per Share.pdf Earnings Per Share Dividend

Earnings Per Share Contents webtel.in

Diluted Earnings per Share Definition & Example

News Release investor.ecolab.com

Earnings Per Share (eps) What is Earnings Per Share (eps

– INTERNATIONAL ACCOUNTING STANDARD 33- EARNINGS PER SHARE

Earnings per share (EPS) up 5% to 1.97 cents For personal

[SNIPPET:3:10]

[SNIPPET:3:10]

[SNIPPET:3:10]

[SNIPPET:3:10]

CALCULATING THE EFFECT OF EMPLOYEE STOCK OPTIONS ON

[SNIPPET:3:10]

Earnings Per Share Basic EPS Calculation Top Examples

[SNIPPET:3:10]

Net Margin (%) 20.4% 21.5% (1.1) pp Diluted earnings per

FOR IMMEDIATE RELEASE Adobe Reports Record Revenue

Diluted Earnings Per Share The diluted EPS takes into account the factors listed above, which can have the effect of diluting the stock. Some say that the diluted earnings per share offers a more realistic look at the company.

Consolidated diluted earnings per share from continuing operations was .36 compared to .24, up 2 percent year to year. Consolidated net income was .8 billion, flat year to year.

Basic and diluted earnings per share Basic earnings per share are based on the profit attributable to owners of the company and the weighted average number of ordinary shares in issue during the year, excluding the shares held by the EBT, 9,613,393 shares (2009: 9,314,386 shares).

Ecolab reduced its full year 2018 adjusted diluted earnings per share forecast to the .20 to .30 range, representing a 11% to 13% increase over 2017. The previous forecast was .30 to .50

of Basic and Diluted Earnings per Share. awards to repurchase common stock at the average market price during the period. Therefore, a higher amount of assumed proceeds (the numerator) and a lower aver-age market price during the reporting peri-od (the denominator) will increase the number of shares that a company can repurchase. An increase in the number of shares that a company can

LO5 – Factor into the diluted earnings per share computations the effect of actual conversion of convertible securities or the exercise of options, warrants, …

Earnings per share information must be included in the financial statements of a public company. Accounting for Earnings per Share walks you through the process of calculating this information. It does so by describing the requirements for calculating and presenting basic earnings per share and diluted earnings per share.

Page 2 of 32 Basic and diluted EPS must be presented even if the amounts are negative (that is, a loss per share). If an entity reports a discontinued operation, basic and diluted amounts per share must be

In determining diluted earnings per share. b. d Item 7. deducted from net income only if declared. Ans. ending of the earliest period reported (regardless of time of issuance). The if-converted method of computing earnings per share data assumes conversion of convertible securities as of the a. d. d. beginning of the earliest period reported (regardless of time of issuance).

The difference between basic and diluted EPS is drawn clearly on the following grounds: Basic EPS is a tool that measures the profit of the firm on per share basis. Diluted EPS is a barometer that measures the quality of earnings per share, of the company.

17/07/2012 · “Definition of ‘Diluted Earnings Per Share – Diluted EPS’ A performance metric used to gauge the quality of a company’s earnings per share (EPS) if all convertible securities were exercised. Convertible securities refers to all outstanding convertible preferred shares, convertible debentures, stock options (primarily employee based) and warrants.

The portion of a company’s profit allocated to each outstanding share of common stock is known as Earnings Per Share or EPS. Though the interpretation of Earnings Per Share is relatively easy, however, the EPS calculation is not this simple. For example, let us have a look at the

(a). Basic and diluted earnings per share Savills

CALCULATING THE EFFECT OF EMPLOYEE STOCK OPTIONS ON

Basic and diluted earnings per share Basic earnings per share are based on the profit attributable to owners of the company and the weighted average number of ordinary shares in issue during the year, excluding the shares held by the EBT, 9,613,393 shares (2009: 9,314,386 shares).

Basic earnings per share . Earnings Shares. Diluted earnings per share . Earnings Shares Dilutive potential ordinary shares. Options, warrants and their equivalents Convertible instruments Contingently issuable shares Contracts that may be settled in ordinary shares or cash Purchased options Written put options . RETROSPECTIVE ADJUSTMENTS PRESENTATION DISCLOSURE EFFECTIVE DATE …

Diluted earnings per share (paras. 30–63): • The numerator is calculated as the profi t or loss attributable to ordinary equity holders of the parent entity, adjusted by the after-tax effect of (para. 33):

If basic and diluted earnings per share are equal, dual presentation can be accomplished in one line on the income statement. IAS 33.66 Has the entity presented basic and diluted earnings per share …

• Diluted earnings per share was [SNIPPET:4:15].84 on a GAAP-basis, and .10 on a non-GAAP basis. • Digital Media segment revenue was .27 billion, with Creative revenue growing to .06 billion. • Digital Media Annualized Recurring Revenue (“ARR”) grew to .87 billion exiting the quarter, a …

revenue recognition standard reduced 2017 adjusted diluted earnings per share by [SNIPPET:4:15].01. We also adopted the new pension accounting standard beginning in 2018, recording the employee compensation cost of pension expense (the service component) in COS and SG&A, while all other

Diluted Earnings per Share 30 Earnings 33 Shares 36 Dilutive Potential Ordinary Shares 41 Hong Kong Accounting Standard 33 Earnings per Share (HKAS 33) is set out in paragraphs 1-76 and Appendices A and B. All the paragraphs have equal authority. HKAS 33 should be read in the context of its objective and the Basis for Conclusions, the Preface to Hong Kong Financial Reporting Standards …

The portion of a company’s profit allocated to each outstanding share of common stock is known as Earnings Per Share or EPS. Though the interpretation of Earnings Per Share is relatively easy, however, the EPS calculation is not this simple. For example, let us have a look at the

– Basic earnings per share 3 1.97 1.88 – Diluted earnings per share 3 1.93 1.85 The above statement should be read in conjunction with the accompanying notes.

Reconciliation – Diluted Earnings Per Share 2018 2017 2018 2017 Reported Diluted Earnings Per Share 1.10$ 0.81$ 2.02$ 0.15$

IAS 33 EARNINGS PER SHARE Grant Thornton LLP

Alphabet Announces Second Quarter 2018 Results

4 IAS 33 Earnings Per Share Diluted earnings per share For the purpose of calculating diluted EPS, an entity shall adjust profit or loss attributable to ordinary equity holders

Diluted Earnings per Share 30 Earnings 33 Shares 36 Dilutive Potential Ordinary Shares 41 Hong Kong Accounting Standard 33 Earnings per Share (HKAS 33) is set out in paragraphs 1-76 and Appendices A and B. All the paragraphs have equal authority. HKAS 33 should be read in the context of its objective and the Basis for Conclusions, the Preface to Hong Kong Financial Reporting Standards …

Diluted earnings per share, or Diluted EPS, is a firm’s net income divided by the sum of it’s average shares and other convertible instruments. A company’s net income can be found on its income statement. A company’s average shares refers to the weighted average of common shares throughout the year. The weights of each factor would be the length of time each quantity of common shares is

Reconciliation – Diluted Earnings Per Share 2018 2017 2018 2017 Reported Diluted Earnings Per Share 1.10$ 0.81$ 2.02$ 0.15$

Diluted Core earnings per share (Diluted Core EPS) calculation is based upon Core net profit after tax adjusted for Preference Dividends, using the weighted average number of ordinary shares adjusted for the effect of dilution.

Facebook Inc’s Earnings per Share (Diluted) for the three months ended in Sep. 2018 was .76. Earnings per Share (Diluted) for the trailing twelve months (TTM) ended in Sep. 2018 was .63.

Compiled AASB Standard AASB 133 Earnings per Share This compiled Standard applies to annual reporting periods beginning on or after 1 July 2012 but before 1 January 2013.

Diluted earnings attributable to BlackRock, Inc. common stockholders per share (2) (3) $ 7.52 $ 5.90 $ 1.62 $ 6.66 $ 0.86 Effective tax rate 16.0 % 30.6 % (1,460 ) bps 23.7 % (770 ) bps See pages 11-12 for the reconciliation to GAAP and notes (1) through (3) for more information on as adjusted items. * Results for 2017 were recast to reflect the adoption of the new revenue recognition standard

LO5 – Factor into the diluted earnings per share computations the effect of actual conversion of convertible securities or the exercise of options, warrants, …

Basic earnings per share (EPS), one of the two measures of EPS required to be disclosed by ASC 260, is calculated by dividing income available to common stockholders (i.e., net income or loss attributable to the

If basic and diluted earnings per share are equal, dual presentation can be accomplished in one line on the income statement. IAS 33.66 Has the entity presented basic and diluted earnings per share …

Diluted earnings per share is a measure of profit. The formula for diluted earnings per share is: The formula for diluted earnings per share is: Fully Diluted Earnings Per Share = ( Net Income – Preferred Stock Dividends) / (Common Shares Outstanding Unexercised Employee Stock Options Convertible Preferred Shares Convertible Debt Warrants)

FA Module 7: Earnings per share and diluted EPS – practice problems (The attached PDF file has better formatting.) Exercise 7.1: Basic earnings per share Selected operating information from a firm’s 20X2 financial statements is cost of goods sold = 100 gross profit margin = 60% EBIT margin = 30% effective tax rate = 20% The

Facebook Earnings per Share (Diluted) (FB) gurufocus.com

THIRD QUARTER 2018 Pre-tax Gross Diluted Net Pre-tax

Facebook Inc’s Earnings per Share (Diluted) for the three months ended in Sep. 2018 was .76. Earnings per Share (Diluted) for the trailing twelve months (TTM) ended in Sep. 2018 was .63.

Analysis. Earning per share is the same as any profitability or market prospect ratio. Higher earnings per share is always better than a lower ratio because this means the company is more profitable and the company has more profits to distribute to its shareholders.

Reconciliation – Diluted Earnings Per Share 2018 2017 2018 2017 Reported Diluted Earnings Per Share 1.10$ 0.81$ 2.02$ 0.15$

Basic earnings per share of Class A and B common stock and Class C capital stock $ 5.09 $ 4.60 $ 12.94 $ 18.13 Diluted earnings per share of Class A and B common stock and

revenue recognition standard reduced 2017 adjusted diluted earnings per share by [SNIPPET:4:15].01. We also adopted the new pension accounting standard beginning in 2018, recording the employee compensation cost of pension expense (the service component) in COS and SG&A, while all other

4 IAS 33 Earnings Per Share Diluted earnings per share For the purpose of calculating diluted EPS, an entity shall adjust profit or loss attributable to ordinary equity holders

Diluted earnings attributable to BlackRock, Inc. common stockholders per share (2) (3) $ 7.52 $ 5.90 $ 1.62 $ 6.66 $ 0.86 Effective tax rate 16.0 % 30.6 % (1,460 ) bps 23.7 % (770 ) bps See pages 11-12 for the reconciliation to GAAP and notes (1) through (3) for more information on as adjusted items. * Results for 2017 were recast to reflect the adoption of the new revenue recognition standard

Diluted earnings per share (EPS) or [SNIPPET:4:15].14 per diluted share, related to the divestitures of Marine Systems International and Broadcast Sports, Inc. Diluted weighted average common shares outstanding for the 2016 first half declined by 6% compared to the 2015 first half due to repurchases of L-3 common stock. Orders: Funded orders for the 2016 second quarter were ,136 million compared to

AT&T Inc’s Earnings per Share (Diluted) for the three months ended in Sep. 2018 was [SNIPPET:4:15].65. Earnings per Share (Diluted) for the trailing twelve months (TTM) ended in Sep. 2018 was .28.

Earnings of .85 to .45 per diluted share before year-end MTM retirement plan accounting adjustments, up from the prior forecast of .65 to .25 per diluted share;

diluted earnings per share The treasury stock method is applied to instruments such as options and warrants. The number of incremental shares is computed using a year-to-date weighted-average number of incremental shares by using the incremental shares from each quarterly diluted earnings-per-share computation. The number of incremental shares is computed independently for each period

Financial Highlights – Fiscal 2018 • Diluted earnings per share was .04 in fiscal 2018, including $(2.06) per share of restructuring costs, $(1.00) per share of transaction, separation and integration-related costs, $(1.37) per share of

Basic and diluted earnings per share Basic earnings per share are based on the profit attributable to owners of the company and the weighted average number of ordinary shares in issue during the year, excluding the shares held by the EBT, 9,613,393 shares (2009: 9,314,386 shares).

For diluted earnings per share (EPS), GAAP requires using the treasury stock method, where proceeds from assumed stock option exercise is used to purchase treasury shares at …

FA Mod 7 Earnings per share and diluted EPS – practice

FOR IMMEDIATE RELEASE MEDIA CONTACT FINANCIAL CONTACT

If basic and diluted earnings per share are equal, dual presentation can be accomplished in one line on the income statement. IAS 33.66 Has the entity presented basic and diluted earnings per share …

United States Dollar Figures in millions unless otherwise stated 2017 2016 Restated 1 2015 Restated 10. EARNINGS PER SHARE (continued) 10.7 Diluted headline earnings/(loss) per share from

Reconciliation – Diluted Earnings Per Share 2018 2017 2018 2017 Reported Diluted Earnings Per Share 1.10$ 0.81$ 2.02$ 0.15$

IAS 33 Earnings per share 2017 – 07 4 Retrospective adjustments If the number of shares increase as a result of a capitalisation, bonus issue or share spilt, or decreases as a result of a reverse share split – the calculation of the basic and diluted earnings per share for all periods presented shall be adjusted retrospectively. If these changes occur after the reporting period but before

Consolidated diluted earnings per share from continuing operations was .36 compared to .24, up 2 percent year to year. Consolidated net income was .8 billion, flat year to year.

diluted common share of [SNIPPET:4:15].83 for the quarter ended Sept. 30, 2017, compared to net income per diluted common share of [SNIPPET:4:15].71 for the quarter ended Sept. 30, 2016, an increase of 16.9 percent. Net income per diluted common share was .46 for the

Diluted Earnings Per Share The diluted EPS takes into account the factors listed above, which can have the effect of diluting the stock. Some say that the diluted earnings per share offers a more realistic look at the company.

Diluted earnings per share, or Diluted EPS, is a firm’s net income divided by the sum of it’s average shares and other convertible instruments. A company’s net income can be found on its income statement. A company’s average shares refers to the weighted average of common shares throughout the year. The weights of each factor would be the length of time each quantity of common shares is

Page 2 of 32 Basic and diluted EPS must be presented even if the amounts are negative (that is, a loss per share). If an entity reports a discontinued operation, basic and diluted amounts per share must be

The portion of a company’s profit allocated to each outstanding share of common stock is known as Earnings Per Share or EPS. Though the interpretation of Earnings Per Share is relatively easy, however, the EPS calculation is not this simple. For example, let us have a look at the

AT&T Earnings per Share (Diluted) (T) gurufocus.com

Difference Between Basic and Diluted EPS (with Comparison

diluted earnings per share The treasury stock method is applied to instruments such as options and warrants. The number of incremental shares is computed using a year-to-date weighted-average number of incremental shares by using the incremental shares from each quarterly diluted earnings-per-share computation. The number of incremental shares is computed independently for each period

• Diluted earnings per share was [SNIPPET:4:15].84 on a GAAP-basis, and .10 on a non-GAAP basis. • Digital Media segment revenue was .27 billion, with Creative revenue growing to .06 billion. • Digital Media Annualized Recurring Revenue (“ARR”) grew to .87 billion exiting the quarter, a …

The difference between basic and diluted EPS is drawn clearly on the following grounds: Basic EPS is a tool that measures the profit of the firm on per share basis. Diluted EPS is a barometer that measures the quality of earnings per share, of the company.

Facebook Inc’s Earnings per Share (Diluted) for the three months ended in Sep. 2018 was .76. Earnings per Share (Diluted) for the trailing twelve months (TTM) ended in Sep. 2018 was .63.

Consolidated diluted earnings per share from continuing operations was .36 compared to .24, up 2 percent year to year. Consolidated net income was .8 billion, flat year to year.