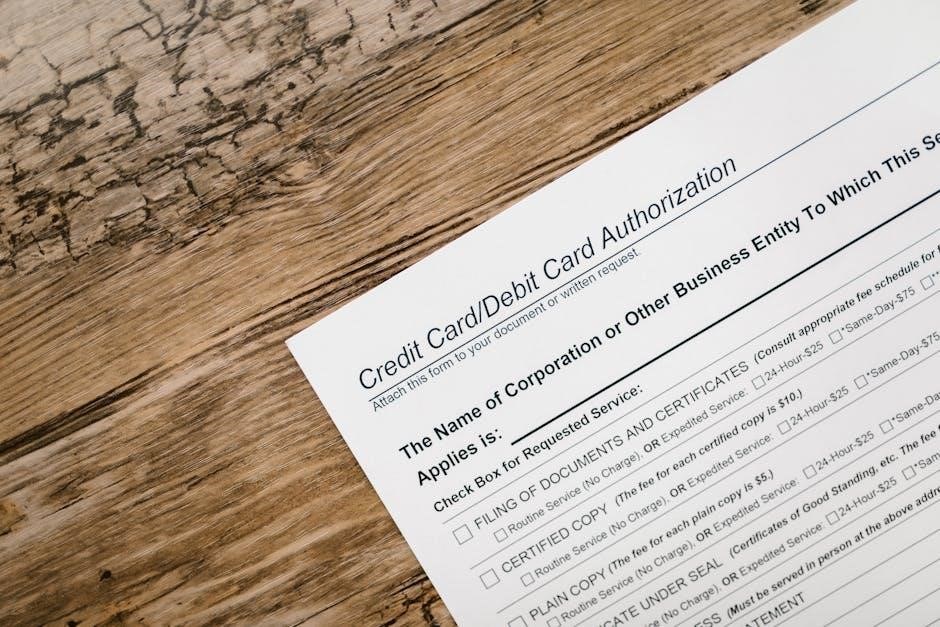

An ACH authorization form is essential for setting up direct deposits or automatic payments. It requires account and routing numbers, a signature, and date to validate transactions securely.

1.1 Definition and Purpose

An ACH authorization form is a written agreement between an account holder and a financial institution, permitting automatic transfers of funds. It ensures secure, legitimate transactions by requiring account details, a signature, and date. Its primary purpose is to validate direct deposits or recurring payments, protecting both parties from unauthorized access and fraudulent activities.

1.2 Importance of ACH Authorization

ACH authorization ensures secure and legitimate transactions by verifying account holder consent. It prevents unauthorized access, protecting both businesses and customers from fraudulent activities. Proper authorization is legally required for direct deposits or recurring payments, safeguarding financial integrity and ensuring compliance with regulations. Without it, transactions may be disputed or reversed, leading to potential legal or financial repercussions.

Key Components of an ACH Authorization Form

An ACH authorization form includes account holder information, bank routing and account numbers, authorization details, and a signature with a date to validate the transaction securely.

2.1 Account Holder Information

Account holder information is crucial for identity verification. It typically includes the account holder’s full name, address, phone number, and Social Security Number (SSN) or Federal Employee Identification Number (FEIN). This ensures the financial institution can accurately identify the account owner and contact them if needed, maintaining security and compliance with financial regulations.

2.2 Bank Routing and Account Numbers

The ACH authorization form requires the bank routing number and account number to facilitate direct transactions. The routing number identifies the financial institution, while the account number specifies the individual account. Both must be accurate to ensure seamless processing. A voided check is often used to verify these details, preventing errors in payment processing.

2.3 Authorization Details

The authorization section specifies the type of transaction, such as direct deposit or recurring payment. It must include the account holder’s signature and date, confirming their consent. A voided check or bank verification may be required to validate account details, ensuring accuracy and security in processing transactions. This section outlines the terms under which the ACH authorization is granted.

2.4 Signature and Date

The signature and date are crucial for validating the ACH authorization form. The account holder must sign and date the document to confirm their consent. The signature serves as legal verification, while the date indicates when the authorization takes effect. A returned form without these elements is considered invalid. A voided check may also be required to verify account ownership.

How to Fill Out an ACH Authorization Form

Filling out an ACH authorization form requires providing accurate account details, including routing and account numbers. Sign and date the form to confirm consent, and attach a voided check if needed. Ensure all information is correct to avoid processing delays.

3.1 Step-by-Step Instructions

To complete an ACH authorization form, provide your full name, address, and account details. Include your bank routing and account numbers, then sign and date the form. Attach a voided check if required. Review all information for accuracy to prevent processing delays. Ensure the form is submitted to the appropriate party, such as your employer or service provider, for verification.

3.2 Required Documentation (Voided Check, etc.)

A voided check is often required to confirm bank details, as it contains the routing and account numbers. Ensure the check is clearly marked “VOID” to prevent unauthorized use. Attach this document to your ACH authorization form for verification. Accurate account information is crucial for successful processing. Review all details before submission to avoid delays or errors.

Legal and Security Considerations

ACH authorization forms must comply with federal regulations to ensure secure transactions. Implementing strong security measures, like encryption, helps prevent fraud and protects sensitive account holder information effectively.

4.1 Compliance with Financial Regulations

ACH authorization forms must adhere to federal regulations, such as those set by NACHA, to ensure legality and security. Proper authorization and disclosure of terms are required. Financial institutions must verify account holder consent and maintain accurate records to avoid penalties. Compliance ensures smooth, lawful transactions and protects both parties involved in the process.

4.2 Security Measures to Prevent Fraud

To prevent fraud, ACH authorization forms require secure handling. Verify account holder details, use voided checks for validation, and ensure forms are stored securely. Implementing encrypted digital storage and regular audits can further protect sensitive information. These measures help mitigate risks and ensure transactions remain safe and authenticated.

Best Practices for Using ACH Authorization Forms

Always verify account details, maintain secure storage, and ensure proper documentation. Regularly review and update authorizations to prevent unauthorized transactions and protect sensitive information effectively.

5.1 Verifying Account Information

Verifying account information is crucial to ensure accuracy and prevent errors. Confirm the account holder’s name, routing number, and account number match the voided check or bank statement. Double-checking these details helps avoid failed transactions or unauthorized access. Ensure the information aligns with the ACH authorization form and update any discrepancies promptly. This step is essential for secure and efficient transactions.

5.2 Maintaining Records

Maintaining accurate records of ACH authorization forms is vital for compliance and security. Keep copies of signed forms, voided checks, and updated account details. Organize records securely, both physically and digitally, to ensure easy access during audits or disputes. Regularly review and update records to reflect any changes in account information or authorization status. This practice helps prevent errors and ensures compliance with financial regulations.

Obtaining an ACH Authorization Form

ACH authorization forms can be obtained by downloading from financial institutions, requesting from employers, or accessing through online payroll services and banking platforms.

6.1 Downloading from Financial Institutions

ACH authorization forms are readily available for download on the official websites of most financial institutions. Visit your bank’s website, navigate to the forms section, and download the PDF. Ensure you use the most recent version to avoid discrepancies. Always verify the website’s security features to prevent fraud and ensure your information stays safe.

6.2 Requesting from Employers or Service Providers

If you don’t have access to the form online, you can request an ACH authorization form directly from your employer or service provider. Provide your account and routing numbers, and sign the document to authorize transactions. Ensure the form is completed accurately to avoid processing delays. Verify the form’s validity and security features before submission.

Troubleshooting Common Issues

Common issues include errors in account numbers or routing details. Verify all information and contact your bank if transactions fail. Ensure the form is fully completed and signed to avoid delays.

7.1 Correcting Errors on the Form

If errors are made on the ACH authorization form, such as incorrect account numbers or routing details, the form must be voided and a new one completed. Ensure all information is accurate before submission. Contact your bank or service provider immediately if errors are discovered after submission to avoid transaction failures or processing delays.

7.2 Revoking ACH Authorization

To revoke an ACH authorization, submit a written request to your bank or service provider. Include your account details and signature for verification. The request must be received at least three business days before the scheduled transaction to prevent unauthorized deductions. Keep a copy of the revocation notice for your records to ensure the authorization is properly canceled.

FAQs About ACH Authorization Forms

Users often inquire about the validity period of ACH authorization and whether forms can be submitted electronically. These questions address common concerns regarding processing and convenience.

8.1 How Long is the Authorization Valid?

The ACH authorization remains valid until revoked, typically lasting indefinitely. Single-use authorizations expire after one transaction, while recurring ones continue until canceled. Users should verify details with their bank or service provider for specific terms and conditions.

8.2 Can the Form be Submitted Electronically?

Yes, ACH authorization forms can often be submitted electronically, depending on the institution or service provider. Many banks and businesses now offer digital forms with e-signature options for convenience. Ensure the submission process is secure, using encryption to protect sensitive data. Always verify the specific requirements with your financial institution or service provider.

Resources for Further Assistance

Contact your bank or financial institution for guidance on ACH authorization forms. Consulting with financial advisors can also provide personalized support and clarify any doubts effectively.

9.1 Contacting Your Bank

Your bank is a primary resource for assistance with ACH authorization forms. They can provide direct downloads, personalized guidance, and clarify any questions. Contacting your bank via phone, email, or in-person visits ensures you receive accurate information tailored to their specific requirements. Many banks also offer step-by-step instructions and support to help you complete the form correctly and securely.

9.2 Consulting Financial Advisors

Financial advisors can provide expert guidance on completing and using ACH authorization forms. They help ensure accuracy, security, and compliance with financial regulations. Advisors can also offer insights into fraud prevention and best practices for managing direct deposits or payments. Consulting a financial advisor is particularly useful for complex transactions or unique financial situations, ensuring your interests are protected.

Understanding and correctly using an ACH authorization form is crucial for secure, efficient transactions. Ensure accuracy, compliance, and security to avoid errors or fraud, and consult professionals if needed.

10.1 Summary of Key Points

An ACH authorization form is a critical document for setting up direct deposits or automatic payments, requiring account holder details, routing numbers, and a signature. It ensures secure and efficient transactions while complying with financial regulations. Proper completion and verification are essential to avoid errors or fraud. Maintaining accurate records and understanding legal obligations are key to effective use.

10.2 Final Tips for Efficient Use

Always verify account details before submission to prevent errors. Use a voided check to ensure accurate routing and account numbers. Ensure signatures are clear and dated to avoid processing delays. Store copies securely to maintain records. Regularly review authorizations to update or revoke as needed. Follow financial institution guidelines for seamless transactions and compliance with regulations.